Lower-price level economy class apartments keep their appeal

The Ober-Haus Apartment Price Index (OHBI) in Lithuania, which records changes in apartment prices in five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in July 2023 (the price index in June 2023 decreased by 0.1%). The apartment prices overall in the major cities of Lithuania have increased by 6.7% over the last 12 months (the annual growth in June 2023 was 9.1%).

The Ober-Haus Apartment Price Index (OHBI) in Lithuania, which records changes in apartment prices in five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in July 2023 (the price index in June 2023 decreased by 0.1%). The apartment prices overall in the major cities of Lithuania have increased by 6.7% over the last 12 months (the annual growth in June 2023 was 9.1%).

In July 2023, apartment sales prices in Vilnius, Kaunas, Šiauliai and Panevėžys increased by 0.3%, 0.4%, 1.4% and 0.7% respectively and the average price per square meter in these cities was EUR 2,557 (+7 EUR/sqm), EUR 1,729 (+6 Eur/sqm), EUR 1,093 (+15 Eur/sqm), and EUR 1,066 (+8 Eur/sqm) respectively. In Klaipėda, apartment sales prices remained the same and the average price per square meter stood at EUR 1,603.

Apartment prices rose year-on-year in July 2023 in all major cities of the country: 7.4% – in Vilnius, 7.0% – in Kaunas, 4.9% – in Klaipėda, 5.1% – in Šiauliai and 4.0% – in Panevėžys.

“Although activity in the housing market in Lithuania weakened in July, this did not have a negative impact on the sales prices of apartments. This is particularly noticeable in the lowest-price segment, which, due to lower prices, is currently attracting a lot of attention from home buyers.

According to the State Enterprise Centre of Registers, in July 2023, compared to the same month last year, 24% less older apartments were purchased in Lithuania (the decrease in Klaipėda stood at 8%, in Kaunas – 26%, in Vilnius – 30%, in Šiauliai – 34%, and in Panevėžys – 35%). If we look at the overall 2023 activity indicators, they were lower only than those in January and February, when the housing market activity usually hits the lowest point. However, historically, such low level of market activity in the older apartment segment was recorded in 2012.

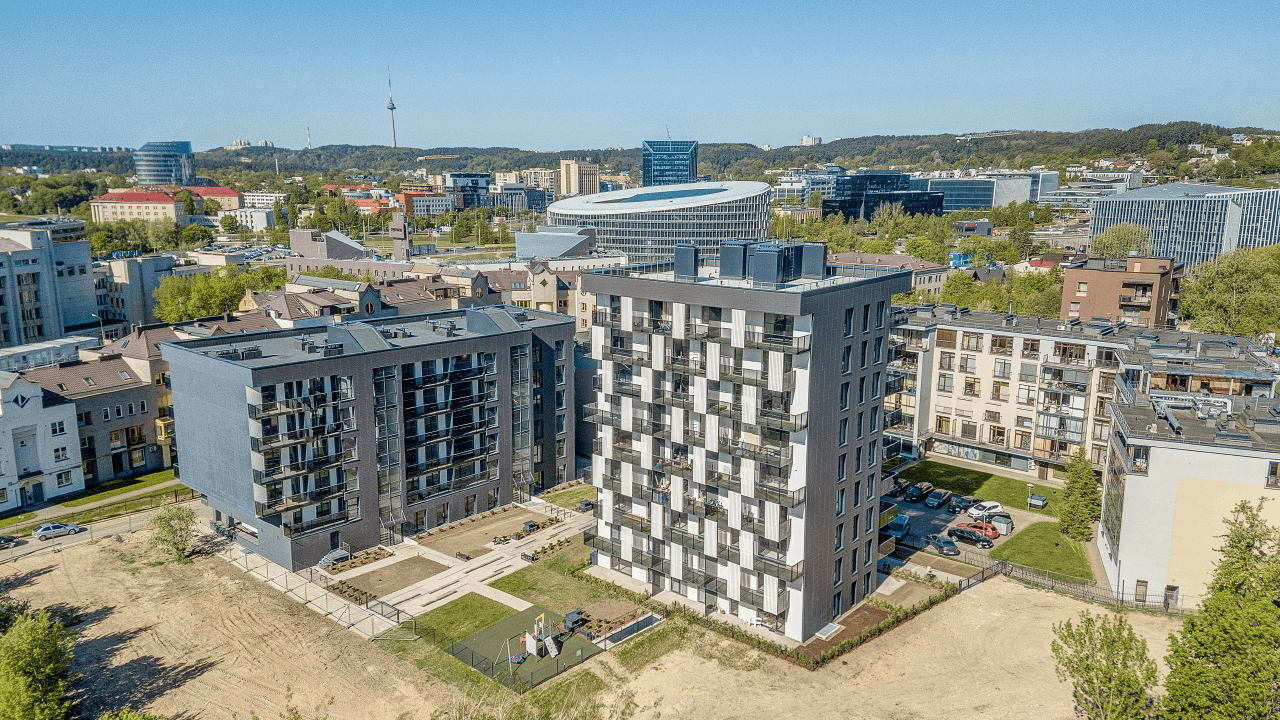

Even though the level of activity in the housing market plummeted in July this year, this did not have a negative impact on the sales prices of apartments, but on the contrary, a slight increase in prices was recorded. One of the reasons for this is the continued high demand for the lowest-price housing on the market today. In an environment of high interest rates and record sales prices, a large number of potential home buyers are forced to look for more economic options, i.e. to lower their expectations and to look for lower quality housing. They find such apartments mostly in standard older apartment blocks in urban residential districts, which account for the largest share of the housing market. The analysis of transactions in the country’s major cities this year shows that sales prices for such housing have continued to show a tendency towards a slight increase. For example, in the capital city, 2-3 room apartments in older blocks in residential districts, recently sold at 1,500–2,500 EUR/sqm. However, if it is a newly refurbished apartment in an older apartment building in good condition (e.g. a recently renovated apartment building), buyers may pay up to 3,000 EUR/sqm. Meanwhile in Kaunas, the purchase prices for such apartments are 1,200–1,800 EUR/sqm and in Klaipėda –1,000–1,700 EUR/sqm. However, if it is a newly refurbished apartment, the selling price in these cities can reach or exceed 2,000 EUR/sqm.

Although sales prices in the more expensive segment (apartments closer to the city centre or in new apartment buildings) have remained stable recently, buyers of such housing are in a much better position to negotiate the purchase price, because the seller of such property understands that the potential buyer has the alternative of purchasing a less expensive (lower quality) home. Therefore, when the housing market activity has significantly cooled down, sellers of more expensive housing, unlike sellers of less expensive housing, are much more likely to reduce the sales price,” commented Raimondas Reginis, Head of Market Research for the Baltic countries at Ober-Haus.

Latest news

All news

All news

Housing market has woken up,…

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes…

In 2024, Lithuanian investment transactions…

The general sentiment in the Lithuanian commercial property market in…

Ober-Haus completes the sale of…

A. Juozapavičiaus Street, Kaunas, the last apartment in the project…

All news

All news